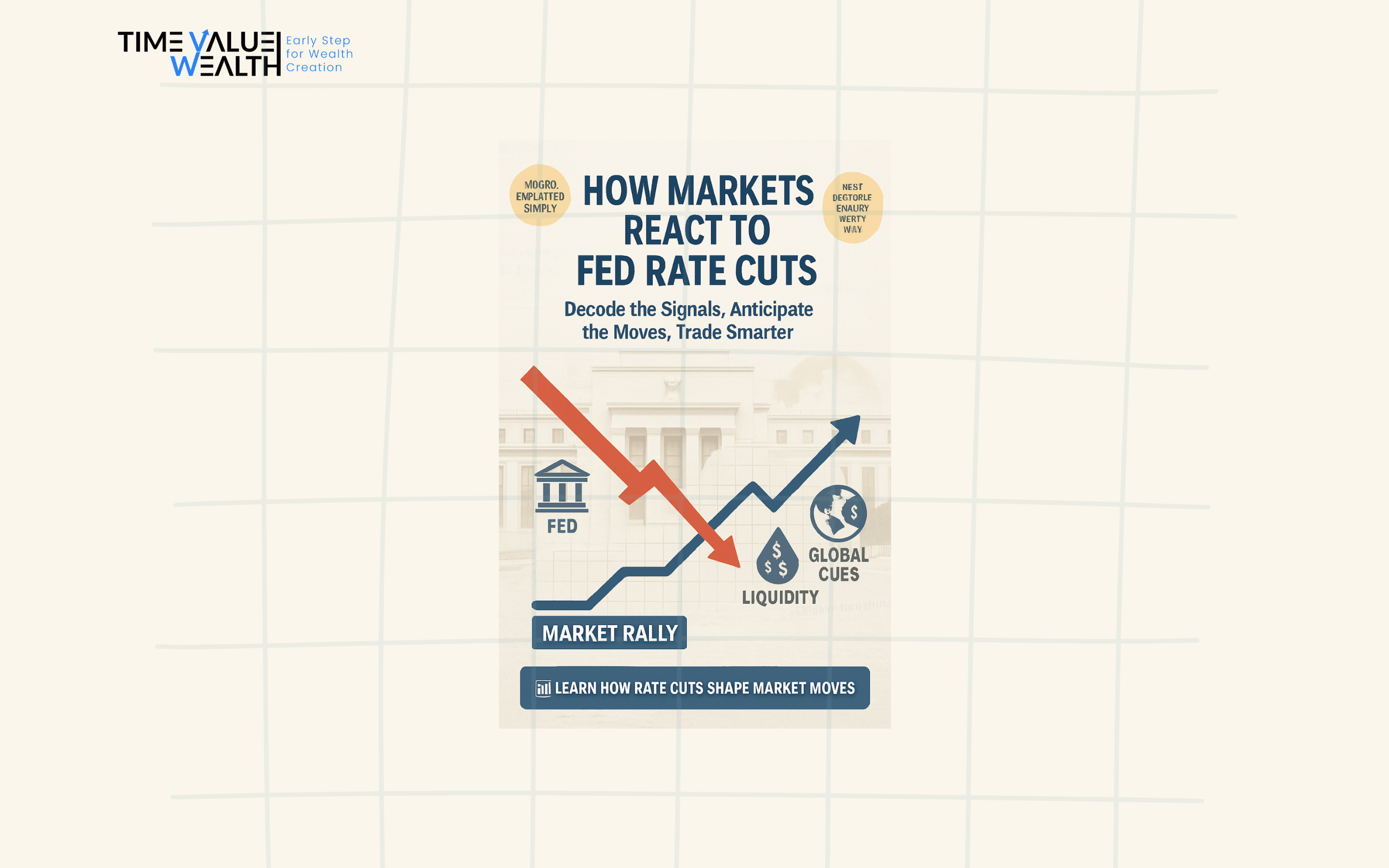

1️⃣ Futures & Options Pricing: What Markets Expect

Before the Fed announces a rate cut, traders predict the outcome using financial instruments like Fed Funds Futures and options data.

- CME FedWatch Tool: Tracks Fed Funds Futures and shows the probability of rate cuts based on market bets.

- VIX (Volatility Index): Rising VIX suggests uncertainty, while low VIX indicates market comfort with a rate cut.

2️⃣ Credit Spreads: Bond Market Clues

The corporate bond market gives clues about investor sentiment toward rate cuts.

- Corporate Bond Spreads: Narrowing spreads indicate market confidence (Bullish), while widening spreads indicate fear (Bearish).

- Junk Bonds: Rising junk bonds indicate a risk-on sentiment (Bullish), while falling junk bonds signal risk aversion (Bearish).

3️⃣ Market Breadth & Sector Rotation: Who Wins & Who Loses?

Different sectors react to rate cuts in various ways. Watch which sectors lead the rally to gauge the market’s outlook.

✅ Bullish Rate Cut Reaction (Healthy Economy):

- Growth stocks (Tech, Consumer Discretionary) rise

- Small caps outperform large caps

- Financials rise (lower borrowing costs boost lending growth)

- Cyclical sectors (Industrials, Energy) rally

✅ Bearish Rate Cut Reaction (Recession Fear):

- Defensive sectors (Utilities, Healthcare) rise

- Gold & Treasuries rally (safe-haven shift)

- Small caps underperform large caps

- Bank stocks fall (lower rates reduce profit margins)

4️⃣ Commodities & Currencies: Inflation vs. Growth Signals

Commodities and currency markets react to rate cuts depending on whether investors see the cut as a growth signal or a sign of slowdown.

- Gold: Rises if the cut signals recession fear; falls if it signals growth.

- Oil & Industrial Metals: Rise if the cut signals economic acceleration; fall if it signals weak demand.

- U.S. Dollar: Weakens if rate cut signals more risk-taking; strengthens if it signals global uncertainty.

5️⃣ Real Yields & Inflation Breakevens: A Deep Dive into Treasury Markets

Looking at real yields and inflation breakevens helps gauge the Fed’s economic stimulus.

- Falling Real Yields: Indicates market expects easy Fed policy (Bullish for stocks).

- Rising Real Yields: Indicates market fears policy mistake (Bearish for stocks).

- Rising Inflation Breakevens: Indicates market expects inflation (Risk-on sentiment).

- Falling Inflation Breakevens: Indicates market expects slowdown (Risk-off sentiment).

Conclusion: Spotting Market Trends Around Rate Cuts

| Indicator | Bullish (Stocks Up) 📈 | Bearish (Stocks Down) 📉 |

|---|---|---|

| Fed Funds Futures (CME Tool) | Rate cut expected & smooth pricing | Unexpected, panic-driven rate cut |

| VIX (Volatility Index) | Falling or stable | Rising (uncertainty) |

| Corporate Bond Spreads | Narrowing (confidence) | Widening (fear) |

| Stock Market Leadership | Tech, small caps, cyclicals rising | Defensives, gold, Treasuries rising |

| Commodities (Gold, Oil, Copper) | Weak gold, strong oil/metals | Gold up, oil/metals down |

| U.S. Dollar (DXY Index) | Falling | Rising |

| Real Yields & Breakevens | Falling real yields, rising breakevens | Rising real yields, falling breakevens |

By monitoring these key indicators, you can better predict how markets will react to rate cuts and position your investments accordingly. Stay ahead of the curve and use data-driven insights to navigate market volatility! 🚀📊